AP Photo/Richard Vogel

Welcome to Insider Cannabis, our weekly newsletter where we're bringing you an inside look at the deals, trends, and personalities driving the multibillion-dollar global cannabis boom.

Sign up here to get it in your inbox every week.

Happy Friday everyone:

What's going on this week? Turning Points Brands, a NYSE-listed company, turned a few heads in the industry this week by announcing an $8 million investment into Old Pal, a California cannabis brand.

Companies that want to maintain their listings on marquee exchanges like the NYSE usually won't touch US cannabis with a 10,000-foot pole. But Turning Points Brands got around that with some clever moves, as Marc Hauser, who co-leads Reed Smith's cannabis practice, noted in his Cannabis Musings newsletter (which you should read).

First, the investment is a convertible note - a form of debt that converts to equity at a later date - and that Old Pal, while nominally a "plant-touching" company, actually operates on a licensing model. So, as Hauser said, TPB is merely lending to a licensing business - not directly investing in a company that traffics in a Schedule I controlled substance.

It'll be interesting to see if other companies follow this model.

What else is happening?

Cannabis was first domesticated in neolithic China, making it one of the oldest domesticated crops known to humanity. New York airports won't seize cannabis found at TSA checkpoints anymore. New Jersey is dismissing 88,000 marijuana possession cases.

Sen. Cory Booker clarified his stance on the SAFE Banking Act, a bill that would let cannabis companies access the banking system in an interview with Yahoo. He called the bill - which has bipartisan support, unlike the broader, social justice-focused legalization bill he, Sen. Schumer, and Sen. Wyden proposed last week - a good "sweetener" to sway moderates to a more progressive vision of full-scale legalization.

He previously said he would try and stop SAFE Banking from advancing ahead of his broader legalization bill at all costs, as you may remember from last week's newsletter.

- Jeremy Berke (@jfberke) & Yeji Jesse Lee (@jesse_yeji)

If you like what you read, share this newsletter with your colleagues, friends, boss, spouse, strangers on the internet, or whomever else would like a weekly dose of cannabis news.

Here's what we wrote about this week:

Check out the pitch decks that hot cannabis startups used to raise millions from top investors

Cannabis startups have raised millions in the last few years, targeting everything from tech, to distribution, to branded products. We've published over a dozen pitch decks from startups like Cann, Dutchie, and Eaze, and gone deep with the founders about their best tips for raising money in an emerging sector like cannabis.

'A generational wealth opportunity': 4 top Wall Street analysts share the cannabis stocks to buy now

Four top Wall Street analysts named their top cannabis stock picks. Here's a look at which companies analysts from Cowen, Jefferies, and others say you should place your bets.

Huge consumer companies from Nestle to Altria are vying for a slice of the exploding CBD market

CBD is already a $2 billion industry in the US, but the cannabis compound's legal status is murky. Still, that hasn't stopped large consumer companies from striking up deals and partnerships to jump into the industry.

See the pitch deck that Compass Pathways used to raise $80 million and fuel its rise into one of the world's biggest psychedelics companies

Compass Pathways is the second-largest psychedelics company in the world by market cap. But in 2019, the company was just getting started. Insider got a hold of a leaked pitch deck the company used to raise $80 million from investors like Otsuka and Founders Fund.

Amazon, investment banks, and even big tobacco are spending millions of dollars to try to get favorable marijuana laws

A record 167 special interests lobbied on cannabis in the second quarter of 2021, an Insider analysis of new lobbying disclosures found. Amazon, Altria, and Morgan Stanley were among the companies lobbying on cannabis banking or legalization.

The CEO of the biggest psychedelics company lays out the 3 challenges he has to address before treatments hit the market

Florian Brand is now the CEO of the biggest psychedelics company in the world. In an interview after Atai's IPO, Brand laid out the three challenges he has to address before treatments hit the market

Top VCs in psychedelics say Big Pharma is knocking at the door - and it could fuel a wave of deals

Insider talked to 11 top VCs in the psychedelics space and asked for their predictions. Three of them said that pharmaceutical companies are eyeing the space and looking for a way in. This article is the first of three that will detail VCs' predictions for the psychedelics industry.

Amir Cohen/Reuters

Executive moves

- California-based cannabis company Harborside announced on Monday that chairman Matt Hawkins would be stepping in as interim CEO. Hawkins runs the cannabis investment firm Entourage Effect Partners. Former CEO of Sublime Ahmer Iqbal has been appointed to COO.

- Psychedelics company Compass Pathways said on Wednesday that it had appointed Danielle Schlosser to senior vice president of clinical innovation.

- Cannabis edibles startup Hervé has appointed a pair of marketing execs in California, including Cheyne Nadeau who joins from Canndescent, and Emily Ryan, from Plus Products. Read our story on Hervé's Series A here.

Deals, launches, and IPOs

- Multistate operator Ayr Wellness announced on Tuesday that it would acquire Illinois-based Herbal Remedies Dispensaries in a $30 million cash and stock deal.

- Cannabis-focused hydroponics company GrowGeneration said on Tuesday that it had acquired Oregon-based Aqua Serene. The investment bank Stifel estimated the deal amounts to $7 million in a note.

- Turning Points Brands, an NYSE-listed company that owns Zig-Zag rolling papers and other smokeless tobacco brands, is investing $8 million into cannabis brand Old Pal through a convertible note.

- Silver Spike Investment Corp. said on Tuesday that it had plans to make an initial public offering on the Nasdaq until the symbol "SSIC."

- Psychedelics company Field Trip Health announced on Friday that it had obtained conditional approval to list on the Nasdaq under the symbol "FTRP."

Research and data

- A new study from the Cannabis Research Center at UC Berkeley found that cannabis grows in California often tap unregulated groundwater sources which may have negative effects on streamflow and wildlife.

- A new study published in the Journal of the International Neuropsychological Society did not find a link between adolescent cannabis use and reduced motivation, but the authors said that greater cannabis use was associated with a devaluing of school.

- A new study published in the journal Science Advances found that cannabis was first domesticated in Neolithic China.

Policy moves

- New York State Senator Jeremy Cooney proposed a new bill that would let cannabis growers harvest and sell cannabis ahead of the final rules and appointments for the state's Office of Cannabis Management. The bill would let growers start next year.

Chart of the week

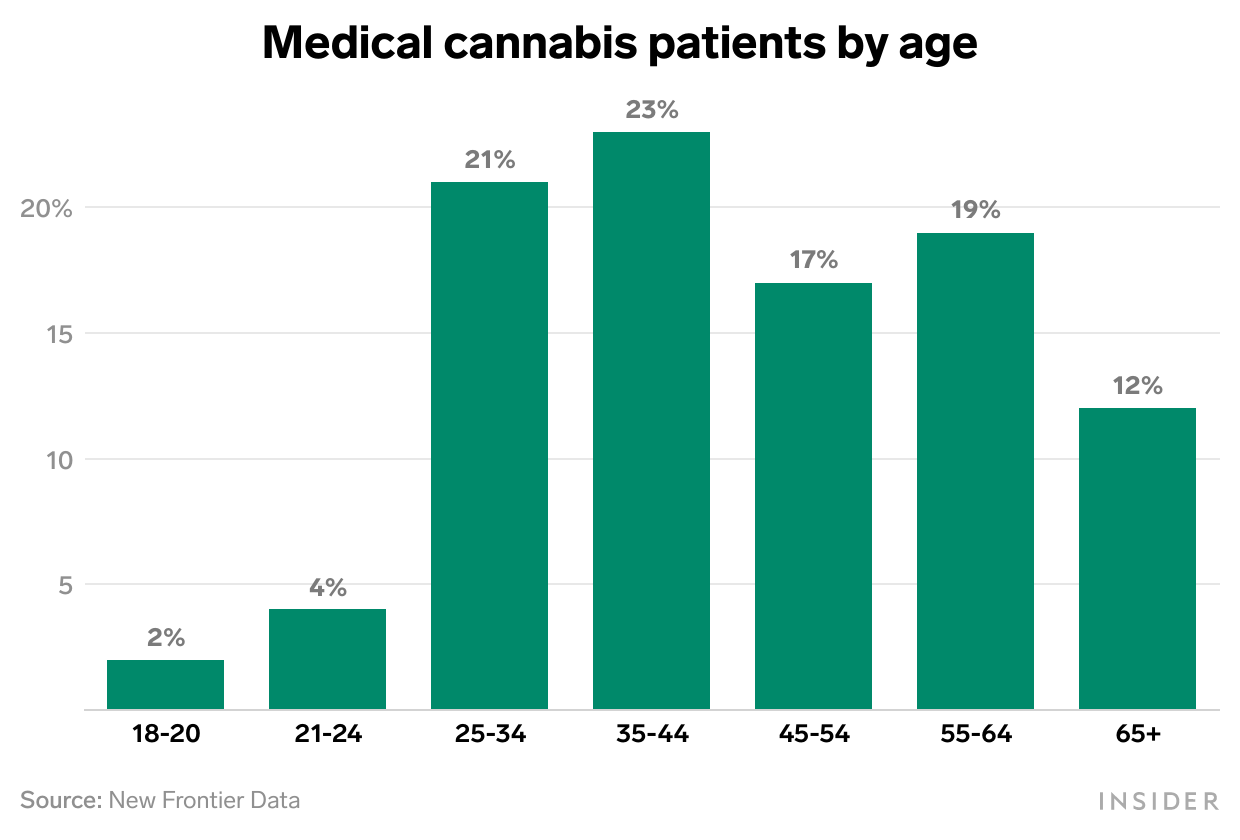

Thirty-five to 44-year-olds in the US make up the largest portion of medical cannabis patients in the country, according to New Frontier Data. Twenty-five to 34-year-olds trail closely behind, making up 21% of all medical patients in the US.

New Frontier Data

What we're reading

What truck drivers really think about new federal regulations to crack down on drug use (Insider)

'It's going to be a bloodbath': Why some Toronto pot store owners are giving up (BNN Bloomberg)

Your shopping mall's latest tenant? A pot dispensary (NBC News)

Thieves are stealing California's scarce water. Where's it going? Illegal marijuana farms (CalMatters)

A man failed workplace drug test days after N.J. legalized weed and was fired. Now he's suing. (NJ Advance Media)